In recent years, the world has witnessed a significant rise in the popularity of cryptocurrencies and decentralized finance (DeFi). These innovative technologies have revolutionized various industries, and the fitness industry is no exception. DeFi payment systems have emerged as a game-changer for fitness centers and gyms, offering a secure, efficient,...

How to Set Up a Gym Payment System: A Complete Guide

In today's digital age, having a reliable and efficient gym payment system is crucial for the success of any fitness facility. A gym payment system allows gym owners to streamline their financial operations, improve customer experience, and ensure smooth transactions. This comprehensive guide will walk you through the process of...

A Complete Guide to Using an Automated Billing System for Gyms

In today's fast-paced world, automation has become a key component in streamlining business operations. One area where automation can greatly benefit gyms is in the billing process. An automated billing system can help gym owners and managers save time, reduce errors, and improve cash flow. In this comprehensive guide, we...

Handling EFT Payments for Gym Membership

In today's digital age, electronic funds transfer (EFT) payments have become increasingly popular for various industries, including the fitness industry. Gym memberships are no exception, as more and more fitness centers are adopting EFT payment systems to streamline their operations and enhance the convenience for their members. In this comprehensive...

Choosing the Right POS for Your Gym

In today's fast-paced world, technology plays a crucial role in the success of businesses across various industries, including the fitness industry. As a gym owner or manager, it is essential to stay up-to-date with the latest technological advancements to streamline your operations and enhance the overall customer experience. One such...

Payment Routing for Multi-Location Gyms

In today's fast-paced world, multi-location gyms are becoming increasingly popular. These gyms offer convenience and flexibility to their members, allowing them to work out at any location that suits their schedule. However, managing payments across multiple locations can be a complex and time-consuming task. This is where payment routing systems...

How to Select the Right Payment Gateway for Your Gym

In today's digital age, having a reliable and efficient payment gateway is crucial for any business, including gyms. A payment gateway is a technology that allows businesses to accept and process payments from their customers securely and conveniently. For gyms, selecting the right payment gateway is essential to ensure smooth...

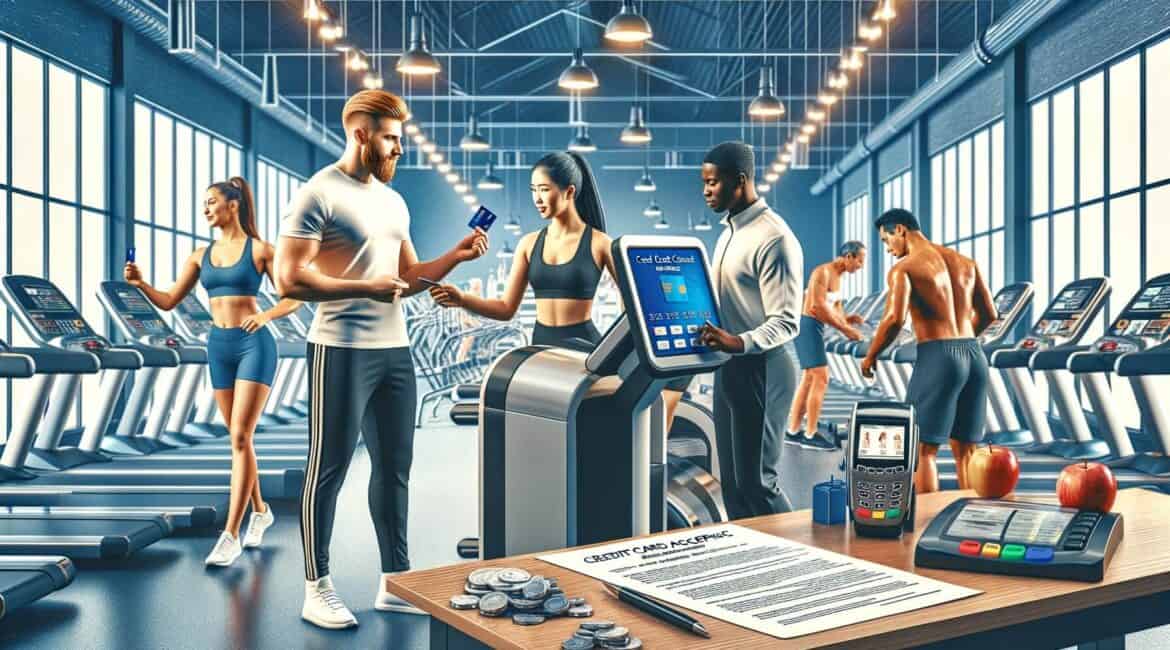

Credit Card Acceptance in Gyms: Benefits and Setup Guide

In today's digital age, credit card acceptance has become a necessity for businesses across various industries. Gyms, in particular, can greatly benefit from accepting credit cards as a form of payment. This article will explore the importance of credit card acceptance in gyms, the benefits it brings, and provide a...

Using Payment Data to Predict Gym Member Retention

In the highly competitive fitness industry, gym member retention is a critical factor for the success and growth of any fitness facility. Retaining existing members is not only more cost-effective than acquiring new ones but also contributes to a positive reputation and a loyal customer base. To achieve high member...

Building Customer Loyalty Through Convenient Payment Plans

In today's competitive business landscape, customer loyalty has become a crucial factor for sustainable growth and success. Building a loyal customer base not only ensures repeat business but also leads to positive word-of-mouth referrals and increased brand reputation. One effective strategy to foster customer loyalty is by offering convenient payment...

Strategies for Minimizing Chargebacks in a Fitness Center

Chargebacks are a common occurrence in the fitness center industry, and they can have a significant impact on the financial health of a business. A chargeback is a transaction reversal initiated by the cardholder's bank, typically due to a dispute or fraudulent activity. When a chargeback occurs, the funds are...

Automating Billing and Recurring Payments for Gym Memberships

In today's fast-paced world, automation has become a key aspect of streamlining business operations. One industry that can greatly benefit from automation is the fitness industry, specifically gym memberships. Automating billing and recurring payments for gym memberships not only saves time and effort for gym owners but also provides convenience...

What a Modern Gym POS System Looks Like

In today's fast-paced and technology-driven world, businesses of all types are relying on modern point-of-sale (POS) systems to streamline their operations and enhance customer experience. The fitness industry is no exception, with gyms and fitness centers recognizing the need for a robust and efficient POS system to manage their daily...

Cash Advances for Gym Owners: Is It Right for Your Business?

Running a gym can be a rewarding business venture, but it also comes with its fair share of financial challenges. From equipment upgrades to marketing campaigns, there are often expenses that need to be covered to keep your gym thriving. This is where cash advances can come in handy for...

Setting Up Payment Processing for a New Gym

Setting up payment processing for a new gym is a crucial step in ensuring smooth financial transactions and providing convenience to your members. In today's digital age, where cashless payments are becoming increasingly popular, it is essential for gyms to offer a variety of payment options to cater to the...

An Overview of PCI Compliance for Fitness Centers

In today's digital age, where technology has become an integral part of our daily lives, ensuring the security of sensitive information has become a top priority for businesses across various industries. Fitness centers, which handle payment card transactions on a regular basis, are no exception. To protect the financial data...

Top Payment Challenges for Fitness Centers

In today's digital age, payment processing has become an integral part of running a successful fitness center. Whether it's collecting membership fees, processing class registrations, or managing recurring payments, fitness centers rely heavily on efficient and secure payment systems. However, the payment landscape for fitness centers is not without its...

Gym Payment Processing Basics: How to Get Started

Gym payment processing is an essential aspect of running a successful fitness facility. Whether you own a small local gym or a large chain of fitness centers, having a reliable and efficient payment processing system is crucial for the smooth operation of your business. In this comprehensive guide, we will...

How Can a Fitness Center Benefit From a Merchant Cash Advance?

In today's competitive business landscape, fitness centers are constantly seeking ways to stay ahead of the curve and provide exceptional services to their clients. However, maintaining and expanding a fitness center requires a significant amount of capital. This is where a merchant cash advance (MCA) can be a game-changer. In...

How to Reduce Payment Fraud in Your Fitness Center

Payment fraud is a growing concern in the fitness industry. With the rise of digital transactions, online memberships, and automated payments, fitness centers face various challenges in safeguarding sensitive financial information. Fraud can lead to financial losses, damaged reputation, and a loss of trust among members. Therefore, it’s crucial for...

Why Mobile Payment Solutions Are Essential for Fitness Centers

In the rapidly evolving fitness industry, technology has become a crucial component of enhancing member experience, optimizing business operations, and staying competitive. One of the most significant technological shifts has been the rise of mobile payment solutions. These solutions enable fitness centers to offer convenient, secure, and flexible payment options...

Why Fitness Centers Need Credit Card Processing

In the modern fitness industry, the ability to accept credit card payments has become a necessity rather than a luxury. Credit card processing plays a critical role in enhancing member experience, ensuring smooth transactions, and facilitating efficient business operations for fitness centers. With the rise of digital payments and the...

How to Reduce Credit Card Processing Fees in Fitness Centers

Looking to reduce credit card processing fees in your fitness center? Read our informative article for detailed explanations and strategies.

How to Set Up Secure Credit Card Processing for Your Gym

In today's fitness industry, secure credit card processing is essential for gyms and fitness centers that want to maintain a trustworthy reputation and ensure financial stability. From managing memberships to handling payments for classes and personal training sessions, a secure payment system is a must to protect customer data and...

How to Manage Credit Card Declines in Fitness Centers

In today's digital age, credit cards have become an essential tool for making payments, including gym memberships and fitness center fees. However, credit card declines can be a frustrating experience for both fitness centers and their members. Understanding the common reasons for credit card declines and implementing strategies to prevent...

Why Payment Security Matters for Fitness Businesses

In today's digital era, payment security is a critical concern for businesses across all sectors, including the fitness industry. As fitness businesses increasingly embrace technology for online payments, memberships, and class registrations, the need for robust payment security becomes even more vital. Protecting customer data, avoiding fraud, and maintaining trust...

Streamlining Payment Processing in Fitness Studios

In today's fast-paced world, efficiency and convenience are key factors in running a successful business. This holds true for fitness studios as well, where streamlining payment processing plays a crucial role in ensuring smooth operations and customer satisfaction. In this article, we will explore the challenges faced by fitness studios...

Why Gyms Need Reliable Payment Processing Solutions

In the fitness industry, providing an exceptional customer experience goes beyond offering top-notch facilities and personal training sessions. One key component that significantly impacts a gym’s operation and member satisfaction is its payment processing system. Reliable payment processing solutions ensure that gyms can manage memberships, subscriptions, and class bookings seamlessly...

How to Handle Payment Disputes for Fitness Event Registrations

When organizing a fitness event, one of the most crucial aspects is handling payment disputes. Payment disputes can arise due to various reasons, such as participant dissatisfaction, technical glitches, or misunderstandings. Failing to address these disputes promptly and effectively can lead to negative consequences for both event organizers and participants....

How to Set Up a Payment Gateway for Online Fitness Classes

Learn how to set up a payment gateway for your online fitness classes. This comprehensive guide provides step-by-step instructions and detailed explanations to help you seamlessly integrate a payment system into your website. From choosing the right payment gateway to configuring it for your specific needs, this article covers everything...

What Are P2P Payments and How Do They Work?

In the digital era, the way people transfer money has undergone a significant transformation. Among the most popular modern payment methods is Peer-to-Peer (P2P) payment systems. P2P payments allow individuals to send money to each other quickly and easily, often without the need for a bank or intermediary. Whether splitting...

How to Reduce Interchange Fees for Your Fitness Business

Interchange fees are a crucial aspect of payment processing that can significantly impact the profitability of fitness businesses. These fees are charged by credit card companies and banks for each transaction made using their payment networks. While interchange fees may seem like a necessary cost of doing business, they can...

The Benefits of EMV for Fitness Businesses

In today's digital age, technology plays a crucial role in almost every aspect of our lives, including the way we make payments. With the rise of contactless payments and online transactions, it is essential for fitness businesses to stay up-to-date with the latest payment technologies to provide a seamless and...

Does Zelle Report to the IRS: A Detailed Guide

In today's digital age, financial transactions have become increasingly convenient and efficient. One such platform that has gained popularity is Zelle, a peer-to-peer payment service that allows users to send and receive money directly from their bank accounts. With its ease of use and widespread adoption, many individuals wonder about...

A Complete Guide to Merchant Category Codes (MCCs)

Merchant Category Codes (MCCs) play a crucial role in the payment industry, providing a standardized way to categorize businesses based on the products or services they offer. These codes are essential for payment processors, card networks, and financial institutions to accurately identify and classify merchants. In this comprehensive guide, we...

What is a Transaction ID: A Detailed Guide

In today's digital age, financial transactions have become an integral part of our lives. Whether it's making a purchase online or transferring funds between bank accounts, we rely on these transactions to be secure and efficient. One crucial element that ensures the smooth functioning of these transactions is the Transaction...

My Venmo Account is Frozen – What Should I Do?

Venmo has become a popular payment app among millions of users, allowing them to easily send and receive money with just a few taps on their smartphones. However, there may come a time when you find yourself in a frustrating situation – your Venmo account is frozen. This can be...

Handling Cryptocurrency Payment Disputes in Fitness Studios

Cryptocurrency has gained significant popularity in recent years, and many fitness studios have started accepting digital currencies as a form of payment. While this offers convenience and flexibility to both the studio and its customers, it also introduces the possibility of payment disputes. In this comprehensive guide, we will explore...

The Benefits of Cryptocurrency for Fitness Businesses

Cryptocurrency has emerged as a revolutionary form of digital currency that operates on decentralized networks known as blockchains. Unlike traditional fiat currencies, such as the US dollar or Euro, cryptocurrencies are not controlled by any central authority, such as a government or financial institution. Instead, they rely on cryptographic technology...

Accepting Cryptocurrency Payments in Fitness Studios

In recent years, the fitness industry has witnessed a significant rise in the adoption of cryptocurrency as a form of payment. Cryptocurrency, such as Bitcoin and Ethereum, has gained popularity due to its decentralized nature and the potential for secure and anonymous transactions. This comprehensive guide aims to provide fitness...

Legal Considerations for Cash Discount Programs in the Fitness Industry

Cash discount programs have become increasingly popular in the fitness industry as a way for businesses to incentivize customers to pay with cash rather than credit cards. These programs offer a discount to customers who choose to pay with cash, effectively passing on the savings from credit card processing fees...

Implementing Cash Discount Programs in Fitness Studios

Cash discount programs have become increasingly popular in various industries, including fitness studios. These programs offer customers the opportunity to save money by paying with cash instead of using credit or debit cards. In this comprehensive guide, we will explore the benefits of implementing cash discount programs in fitness studios,...

Handling ACH Payment Disputes in Fitness Payment Processing

In the fitness industry, ACH (Automated Clearing House) payment disputes can be a common occurrence. ACH payments are electronic transfers of funds between bank accounts, and they are widely used for recurring payments in the fitness industry. However, disputes can arise when customers question the validity or accuracy of these...

Future Trends in ACH Payment Processing for Fitness Businesses

In today's digital age, businesses across various industries are increasingly adopting electronic payment methods to streamline their operations and enhance customer convenience. The fitness industry is no exception, with fitness businesses recognizing the benefits of Automated Clearing House (ACH) payment processing. ACH payment processing allows fitness businesses to accept electronic...

How to Reduce ACH Payment Processing Fees in the Fitness Industry

In today's digital age, the fitness industry has embraced technology to streamline various aspects of their business operations, including payment processing. One popular method of payment in the fitness industry is ACH (Automated Clearing House) payments. ACH payments offer numerous benefits for fitness businesses, such as convenience, security, and cost-effectiveness....

ACH vs. Card Transactions: Which is Right for your Fitness Business

In today's digital age, businesses have a plethora of payment options to choose from. Two popular methods are ACH (Automated Clearing House) transactions and card transactions. Both offer convenience and efficiency, but understanding the differences between the two is crucial for fitness businesses to make an informed decision. This article...

How to Set Up ACH Payment Processing for Your Fitness Business

In today's digital age, businesses across various industries are constantly seeking ways to streamline their payment processes and provide convenience to their customers. The fitness industry is no exception, as gym owners and fitness professionals are increasingly turning to ACH payment processing as a reliable and efficient method for collecting...

The Benefits of ACH Payments for Fitness Studios

In today's digital age, businesses across various industries are constantly seeking ways to streamline their payment processes and improve customer satisfaction. Fitness studios, in particular, can greatly benefit from adopting Automated Clearing House (ACH) payments as a preferred method of transaction. ACH payments offer numerous advantages, including streamlined membership and...

The Future of Credit Card Processing in the Fitness Industry

In today's digital age, credit card processing has become an essential part of running a successful fitness business. Gone are the days of cash-only transactions and manual record-keeping. With the advent of technology, credit card processing has evolved significantly, offering numerous benefits to fitness businesses. This article will explore the...

Credit Card Processing Solutions for Online Fitness Programs

In today's digital age, online fitness programs have gained immense popularity. With the convenience of working out from home and the flexibility of choosing from a wide range of fitness classes, more and more people are opting for these programs. As the demand for online fitness programs continues to grow,...